Chinese electric car manufacturers

Photographer: Greg Baker/AFP via Getty Images

Photographer: Greg Baker/AFP via Getty Images

“There are way too many entrants inside industry, and some of these are only speculators, ” stated Yin Chengliang, a professor at Shanghai Jiao Tong University’s Institute of Automotive Engineering. “The government must enhance the threshold. it is bad to see unreasonable investments in projects with reduced technology amounts.”

Overcapacity Problems

The potential limit on EV startups comes because the world’s biggest auto industry grapples with overcapacity and high inventories. Carmakers are seeing stress on their income aided by the spread of low priced designs, while stringent fuel-economy and emissions targets are set to boost prices.

Asia exceeded the U.S. a year ago to become the world’s biggest marketplace for new-energy cars - comprising electric automobiles, plug-in hybrids and fuel-cell vehicles. Domestic automakers offered 331, 092 units in 2015, in accordance with the Asia Association of vehicle brands.

The government’s sales target is 3 million units a year by 2025 - a 10-fold boost - and it also’s offering subsidies that can total 60 percent of an electric-car’s car or truck. There currently tend to be about 4, 000 new-energy car, or NEV, designs in development.

“It’s true we’re focusing support to build up new-energy automobiles, but should we allow everybody to go forward?” said Dong Yang, government vice-chairman associated with producers’ organization.

10 Permits

The Ministry of business and it is considering restricting the amount of startup EV makers to a maximum of 10, stated Dong, whom fulfills on a regular basis with its officials. That matter won’t include standard carmakers eg SAIC engine Corp. and BYD Co. which are building NEVs.

The MIIT didn’t answer a faxed ask for remark.

However also those startups getting licenses have more mandates to fulfill before changing to their assembly lines, given that federal government presents stricter quality-control measures.

Unique ideas in your inbox, from our technology reporters all over the world.

Get Fully Charged, from Bloomberg Technology.

Business

Your everyday dosage of the development that is moving areas worldwide.

You may now have the company newsletterPolitics

Modern governmental development, analysis, maps, and dispatches through the promotion trail.

Could today receive the Politics publicationAreas

Everything you need to learn about what’s moving areas, in your inbox daily.

You may now get the Markets publicationPursuits

What to consume, take in, wear and drive – in true to life and your desires.

You may now have the Pursuits publicationGame Plan

Guidance nobody lets you know about getting ahead in the office, college and life.

You will today have the idea newsletter In a draft policy document published for public feedback this thirty days, the MIIT listed 17 technologies that companies intending to sell electric automobiles must possess in order to make sure “healthy” improvement a. Those consist of a control system that determines the overall performance and stability regarding the NEV, an information system that tracks the sources and problems of key components, and an activity for recycling or reusing battery packs.Meeting Requirements

The Economic regular, an official newsprint run because of the State Council, said 90 % of organizations at this time establishing EV platforms nonetheless won’t meet up with the criteria in two years. The report cited unnamed business analysts.

The Economic regular, an official newsprint run because of the State Council, said 90 % of organizations at this time establishing EV platforms nonetheless won’t meet up with the criteria in two years. The report cited unnamed business analysts.

One effective candidate is Beijing Electric car Co., that will be controlled by BAIC Group, the state-owned manufacturer for Hyundai engine Co. and Daimler AG’s Mercedes-Benz. It'll build a factory in money city that is with the capacity of making 70, 000 EVs a-year.

One other is Hangzhou Changjiang traveler car Co., which counts Hong Kong-traded FDG Electric Vehicles Ltd. as an important shareholder.

As soon as in the verge of removal, the former state-owned coach manufacturer ended up being revived by an infusion from FDG, which matters Li’s foundation as a minority investor. Li has actually around net worth of .2 billion, in line with the Bloomberg Billionaires Index.

‘Huge Problem’

“The rate of which they’re giving permission is worrying, ” said Zhang Zhiyong, a Beijing-based independent automobile analyst. “Many businesses tend to be making their particular production facilities, but they’re blocked at home from obtaining licenses. This Can Be a giant problem.”

The NDRC performedn’t answer a faxed obtain opinion.

The startups intending to make an application for manufacturing licenses feature Wanxiang Group Corp., owner of Karma Automotive LLC, which revealed a hybrid that uses solar powered energy and prices above 5, 000. Its 5 million factory is in the offing for Hangzhou.

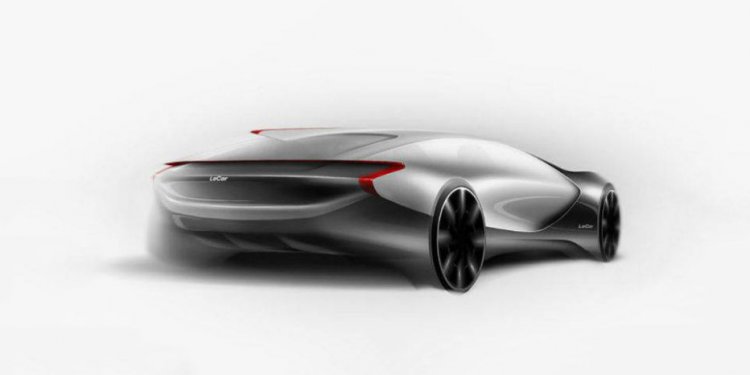

The LeSee idea vehicle by LeEco.

Photographer: Qilai Shen/Bloomberg

Another is Jia’s LeEco, stated Huang Hao, a Beijing-based spokesman. LeEco will invest 6 billion yuan in a factory with initial capacity for 200, 000 vehicles a year, the company stated Aug. 10.

The third is WM engine, which stated Aug. 17 it lifted $1 billion in an initial fundraising round with intends to introduce its very first design in 2018. The organization had been launched this past year by Freeman Shen, a former government at Volvo Cars owner Zhejiang Geely Holding Group Co.

‘Chaotic’ Circumstance

“It’s suitable for MIIT to send out the sign that not everybody could possibly get the permit, ” Shen stated. “The present circumstance is a little bit crazy with too many unqualified businesses, such as low-speed EV makers and auto-parts organizations, joining in competition.”

The us government additionally plans to phase on subsidies after 2020, removing an incentive for startups depending on them to produce profitability. Last year, the average EV maker produced about 3, 000 automobiles, far underneath the scale needed to ensure returns on investment, stated Wang Cheng, the state within China Automotive tech and Research Center.

Some organizations and regional authorities dedicated to making NEVs and batteries and even though they are lacking the mandatory technology, and that worsened overcapacity, Wang said last thirty days.

“There’s undoubtedly a bubble, ” stated Yale Zhang, a managing manager at researcher Autoforesight Shanghai Co. “If you don’t get the core technology and can’t develop the brand name, it's ‘game over’ rapidly once you burn through money.”