Consumer behaviour in automobile industry

The car is main into the United states tale. We have been a people of motion and alter. The firms associated with the automotive aftermarket and petroleum-marketing industries – key to that sight of The united states – know all about modification. The NPD Group is when those businesses turn when seeking to know how United states customers’ purchasing habits tend to be moving.

The car is main into the United states tale. We have been a people of motion and alter. The firms associated with the automotive aftermarket and petroleum-marketing industries – key to that sight of The united states – know all about modification. The NPD Group is when those businesses turn when seeking to know how United states customers’ purchasing habits tend to be moving.

For over a-quarter century we’ve monitored purchasing trends; collected consumer information; polled motorists, mechanics, and DIYers; and crunched the numbers – all to support industry leaders in their strategic decision-making.

Install full data category recordAutomotive

ItemsRetail Tracking

Our Retail Tracking Service delivers unequaled point-of-sale information to realize marketplace characteristics, companion with retailers, and identify development possibilities. Like no other resource, currently a whole and precise view associated with automotive products market. Information is gathered from our retail panel covering 80 % regarding the complete U.S. marketplace, including 18 merchants from size and automotive specialty channels.

Weekly Retail Monitoring

you will monitor product releases, campaigns, and regular sales cycles, especially when quick marketplace response is necessary. This solution delivers a clear view of a promotion’s effect through the few days or weeks the marketing occasion took place. It provides the mobility to better evaluate sales affected by holiday breaks, periods, and weather occasions. You can use this regular information to evaluate real market price modifications with increased accuracy, to help you better align pricing with drivers. It enables an apples-to-apples contrast to year-ago time periods.

you will monitor product releases, campaigns, and regular sales cycles, especially when quick marketplace response is necessary. This solution delivers a clear view of a promotion’s effect through the few days or weeks the marketing occasion took place. It provides the mobility to better evaluate sales affected by holiday breaks, periods, and weather occasions. You can use this regular information to evaluate real market price modifications with increased accuracy, to help you better align pricing with drivers. It enables an apples-to-apples contrast to year-ago time periods.

Store-Level Allowed Retail Tracking

Store-Level Enabled Retail monitoring complements our national Retail monitoring provider – it can help you determine whether sales are distribution-driven or whether particular places tend to be contributing much more to nationwide share or driving growth. The velocity measure set that is part of Store-Level Enabled Retail monitoring takes into consideration product sales volume (Annualized business amount or AIV) without considering shop matter alone, for a far more meaningful keep reading in which items are selling and exactly how these are generally carrying out.

Account Amount Reports

These reports permit retailers who choose this option to share their information with authorized sellers, allowing vendors to evaluate business overall performance at certain stores down to that level in many instances. By simply making this report open to their particular suppliers, retailers can perhaps work along with all of them to enhance overall performance. These reports may only be made readily available with all the present permission regarding the store.

These reports permit retailers who choose this option to share their information with authorized sellers, allowing vendors to evaluate business overall performance at certain stores down to that level in many instances. By simply making this report open to their particular suppliers, retailers can perhaps work along with all of them to enhance overall performance. These reports may only be made readily available with all the present permission regarding the store.

Automobile Care Track

Check out automobile Care Track for detailed consumer behavior data for mapping long-lasting, lasting growth in the automotive industry. With consumer profiles, category trends, and customer purchase behavior information, it offers a whole profile associated with “do-it-yourself” and “do-it-for-me” customer markets for the U.S.

Motor Fuels Index

Explore the absolute most comprehensive source of information for understanding the fuel consumer and tracking styles inside U.S. gas market. According to information provided by significantly more than 200, 000 households yearly, engine Fuels Index assists petroleum advertising and marketing companies study and respond to shifts in consumer behavior and maintain marketplace changes.

Categories

- Unleaded fuel (regular, mid-grade, premium)

- Diesel

- Alternate Fuels

Searching Activity Solutions

Obtain access to ideas on shopping, browsing, and purchasing visits across all networks, stores, groups, and demographics. See transformation rate and normal spend measures and see the way they differ by merchant, season, and demographic. Gain an awareness of where else your consumer is shopping and buying.

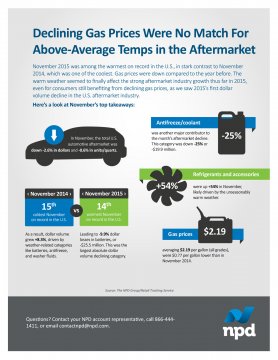

ReportsRegardless of the decrease in fuel costs when compared to earlier November, the extension of fall’s warmer-than-average conditions in much of the united states led to 1st buck volume decline of 2015 when it comes to U.S. aftermarket.

The entire U.S. Consumer esteem Index may have grown by +3.7 per cent in October versus year-ago, but self-confidence in the Texas Region declined by -9.7 per cent in the same period. Reduced gas costs have had an adverse effect on the oil and gas industry – causing layoffs or prospective layoffs much less driving (which, in turn, means less upkeep).

It absolutely was the perfect violent storm the automotive aftermarket in September – moderate weather condition prevailed, and normal fuel prices were a dollar significantly less than they certainly were at the same time just last year. The extended good weather condition and less pricey gas combined to build development in a number of categories.